1) Kala and I are flying to South Africa on Monday, March 16th and are staying there until April 13th.

2) Not only that, but we are also taking a short cruise from April 1st through April 5th. I was able to track the ship we will be cruising on and it has been in South African waters for over a month. The last I heard, there were no known COVID-19 cases in South Africa.

Fear Is Causing Completely Irrational Behavior

The number of people worldwide infected with the coronavirus is now over 121,000 and more than 4,400 people have died from the virus. The worldwide data seems to indicate that the overall death rate is around 3.5% and it’s much higher for seniors and people with ill health. The fatality rates, however, might not be based upon actual facts about COVID-19 because most people are not being tested so we really have no idea of who might have had COVID-19 and recovered. You can get similar symptoms from pollen so a case of COVID-19 could be mild and you won’t even know you had contracted it.

South Korea has been doing the most testing and their death rate is about 0.65%— which is pretty close to flu levels. As a result, the markets will recover from this madness and my guess is sooner rather than later. I want to remind people that you only trade your beliefs about the markets – not the markets themselves. The beliefs most people have, when accompanied by massive fear, are not useful for trading and investing.

The coronavirus is having a tremendous impact on travel, global trade, and supply chains. It’s interesting that I was just offered a free cruise by Royal Caribbean in the Mediterranean and the Baltics. Here in North Carolina we’ve had only a handful of documented cases but you can’t find hand sanitizer in the stores nor toilet paper. To me, that is ridiculous. It’s like people are convinced they’ll get the disease.

Fear levels are very, very high. The volatility index (VIX) has only been as high as it is now twice before – during the financial crisis in 2008 and back in October 1987 when the Dow lost 22.7% in one day.

The U.S. economy was in good shape before the coronavirus hit and should be able to weather any brief slowdown. In addition, lower oil prices that caused such panic on March 9th are actually positive for consumers. Add in low interest rates (which will undoubtedly go lower again next week), and you have the strong likelihood that consumers will spend, especially with unemployment so low right now. Most people who want a job have one.

Market Reaction or Overreaction?

We’ve had a huge bull market. Thus, many traders have been in the market at huge leverage levels. Consequently, when there is any sort of panic selling, leveraged traders have to get out of their positions. It’s a little like the huge rally recently in Tesla, which I believe was mostly caused by short covering in a strong rally.

It’s been more than 11 years since we’ve seen a down day like Monday, March 9th in the market. Investors sold pretty much everything, as more than 95% of stocks in the market were down. In addition, BTC (which is supposed to be a totally non-correlated asset class) was down quite a bit also and gold stocks didn’t seem to provide much protection.

Here are a few of the things that are going on:

- Oil prices dropped below $30 a barrel overnight on Sunday because Russia and Saudi Arabia have started a price war – which will be a boost to most of our economy. Saudi Arabia is aiming for a higher market share and hence lower prices. Prices dropped nearly 25% in a single day.

- The Coronavirus spread seems to be slowing in China. Perhaps there will be a seasonal effect in that as temperatures warm the impact will go down.

- The Coronavirus only seems to strongly impact the aged and those who are already sick. One Australian man died from Coronavirus but he also had Dengue Fever which is much deadlier than COVID-19. The virus seems to have little impact on healthy youth and adults.

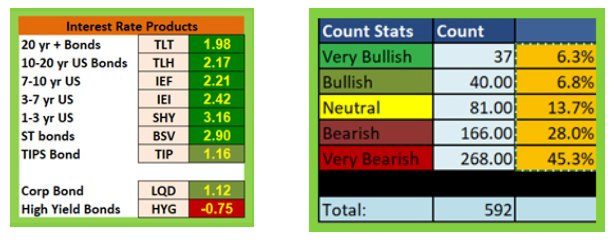

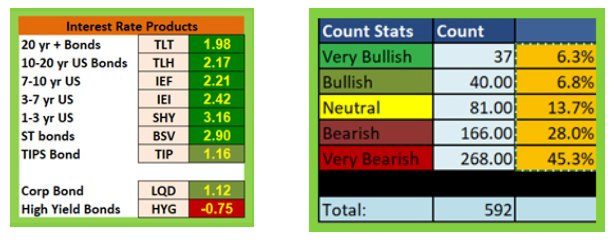

- Yields on 10-year US Treasury notes went as low as 0.319% as investors fled to the safety of bonds. That also means lower rates for borrowing which will increase liquidity and borrowing. I noticed that interest rate products in my retirement portfolio had done nothing to protect me from the March 9th downturn.

- The Dow fell a record 2,000 points when trading opened Monday morning and the S&P 500 was poised for its largest single-day percentage drop since December 2008 in the depths of the global financial crisis. The Dow was down 19% at its Monday low — which is just 1% above the traditional definition of a bear market.

- The graph below shows the S&P 500 weekly prices.

- Data suggests the global economy toppled into a recession this quarter. Figures from China over the weekend showed their exports fell 17.2% in January-February from a year earlier.

- The fall in U.S. yields and Fed rate expectations pushed the dollar to its largest weekly loss in four years before it recovered some ground on Tuesday.

I looked at a couple of newsletter press releases yesterday.

Steve Sjuggerud of True Wealth wrote on March 6th:

So you may be surprised to hear this… but I am extremely excited to buy. No, I haven’t bought yet. But I will personally be a big buyer very soon – when we start to see the beginning of a new uptrend.

Motley Fool (March 9th) says:

Historical data indicates that market declines of 10% happen about once every 11 months on average (and 20% every four or five years). So we didn’t know when the market would decline. But we knew that a downturn of 10% or more was inevitable at some point. And while it’s always painful to watch stocks decline, we built our investing strategy to handle downturns — and to prime us for prosperity in the decades to come.

My Advice

1) The S&P 500 moved into a Bear Volatile market type three days ago according to our Market SQN® score. Bear and Volatile strategies could come into play now. We haven’t presented our Bear Market workshop for several years and we have been planning to release an elearning version of the course. That release is still probably 3-4 months away but with the ability to help traders understand the bear market type, we have just released a “rough cut” version of the course as video on demand. You can get more information HERE.

2) Our BTC trading system signaled an exit on Sunday as the stop was hit. This was only the 3rd loss the system has had, the biggest loss at —14%, and the shortest duration of any trade for the system. It seems that BTC traders also went into panic mode on Monday. The trade history is shown below –

1) I haven’t touched anything in my retirement plan. It was down more than 10% on Monday – one of the biggest single day declines ever, however, I’m sticking with my stops. One of my employees is in an age defined plan with American Funds. She’s old enough that her plan should be conservative but her account was also down 10% on March 9th.

2) I will probably go to 20% cash before I leave on my trip – as I often do before travelling.

3) I have kept a position in Gold. When we get negative interest rates (and for a while on Monday every debt instrument was yielding less than 1% for the 1st time in history), the Fed has to print massive amounts of money. It may take a while but this will lead to a tremendous upswing in gold. In the wake of the global financial crisis, gold went from $682 in 2008 to a $1,921 in 2011. It’s currently between $1,600 and $1,700.

4) I haven’t touched my long-term position in GBTC and I don’t plan to. I still expect 2020 to be a huge bull market for BTC.